Which hedge funds have the highest returns? I will make a good list of the best hedge funds based on the results of the top stocks they own.

Could you keep reading to find out what they are? Besides that, we’ll look at the best hedge funds of all time, which you can go straight to.

ALSO READ – Hedge Funds vs Stocks

Now, let’s get started.

What Is The Top U.S. Hedge Funds Of January 2024

The total number of hedge funds worldwide is greater than the number of Burger King restaurants—30,077 funds compared to a mere 18,700 Burger Kings. Of this multitude of investment managers, a majority of 65% can be found in the United States.

Given that there are more hedge fund managers and assets in the U.S. than in any other country, I’ve compiled a list of the top ten hedge fund managers in the U.S. based on total assets under management.

Some names may be familiar, others less so, but they manage almost a fifth of global hedge fund assets together.

In addition, here are the most significant trends in the hedge fund industry for 2024:

1. Virtual work and meetings for investors are here to stay. This trend offers industry professionals more flexibility in choosing residences and reduces unproductive commuting time.

Traveling is expensive, time-consuming, and tiring. Investors will increasingly conduct most non-office meetings virtually to enhance efficiency, reserving in-person visits for their select list of top managers.

Furthermore, since virtual meetings are often recorded, they can be easily shared with other members of the investment team or reviewed later.

Investors have also noticed that senior members of hedge fund teams are more likely to participate in virtual meetings than in-person meetings held at investors’ offices.

This trend will also apply to cap intro events, where investors can efficiently meet with many quality managers over a short period.

2. Increased demand for managed accounts. A growing number of large investors are opting for individually managed separate accounts.

They seek greater control over their assets, increased leverage, better management of expenses allocated to their accounts, and enhanced transparency.

Consequently, we anticipate more managers being inclined to handle separate accounts and a decline in the minimum required assets for such accounts.

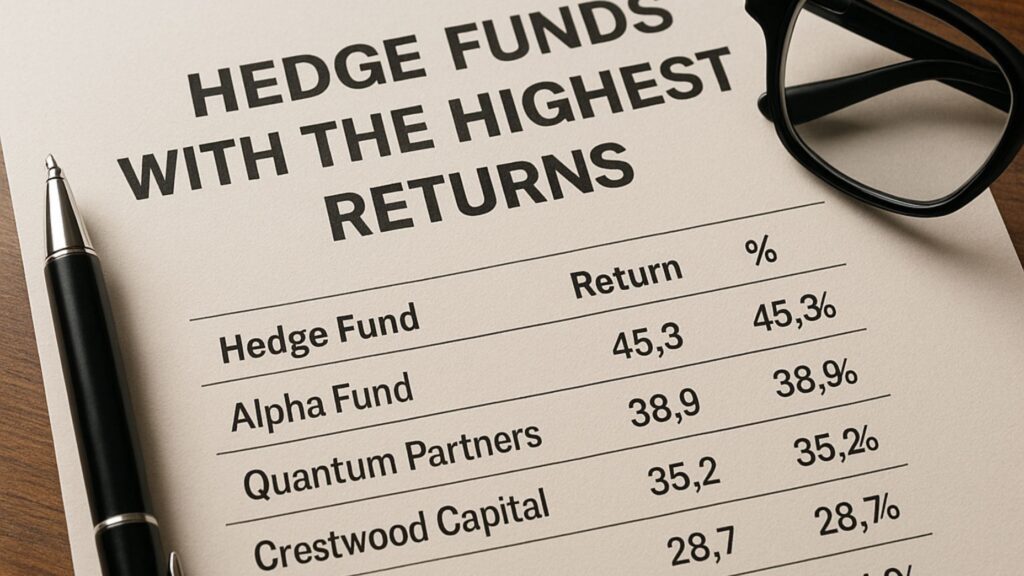

Which Hedge Funds Have The Highest Returns

Take a look at the best hedge funds:

1. Bridgewater Partners LP

Bridgewater Associates, started by Ray Dalio in 1975, is famous for its expertise in the “global macro” style of investing.

This style uses a top-down method to guess, understand, and bet on big-picture economic and political events.

The company is also known for being the first to use the “risk parity” method, which tries to ensure that each asset in a portfolio contributes the same amount of risk.

2. The Steinhardt Partnership Started in 1967

Net Gains Since the Start: $14.8 Billion

Steinhardt Partners was one of history’s most famous and essential hedge funds. It was started by Michael Steinhardt in 1967.

Steinhardt performed better than his coworkers at the hedge fund, achieving an average yearly return that was over 30% higher than every market comparison.

3. Renaissance Technologies, Inc.

James Simons started Renaissance Technologies in 1982 with a focus on numbers. Simons is a mathematician who attended MIT and the University of California, Berkeley and worked as a codebreaker for the National Security Agency.

Renaissance relies heavily on quantitative trading, which means analyzing large amounts of market data to find trends and exploit inefficiencies.

The Medallion Fund, its best-known and most valuable fund, was set up in 1988.

4. The Tudor Investment Corp. Started in 1980

$27 billion in net gains since the beginning.

An American financial company called Tudor Financial Corporation was started in 1980 by Paul Tudor Jones.

It is based in Connecticut. The hedge fund manages fixed income, currency stock, and commodity assets.

Jones correctly forecasted the stock market crash known as the Markey in 1987.

\The hedge fund became famous that year because its short bets gained 62% while the Dow Jones Industrial Average fell 22%.

To protect itself from rising prices, the hedge fund added bitcoin purchases to its portfolio in 2022.

ALSO READ – Hedge Funds vs Mutual Funds Returns

What Is The Most Powerful Hedge Fund In The World?

In 1975, the first Bridgewater Associates office was in Dalio’s two-bedroom New York apartment. He grew it into the biggest hedge fund company in the world.

At its peak in 2022, the world’s biggest hedge fund, Bridgewater Associates, had $168 billion under control.

That made it more than twice the size of the second-largest hedge fund. Bridgewater’s founder, billionaire Ray Dalio, was all over the financial news and publicly said that he had found “the holy grail” of investing: a set of trading formulas guaranteed to make money.

“If you find this thing, you will be prosperous. Right now, Bridgewater is the biggest hedge fund in the world, and Dalio is worth about $19 billion.

The fund works with institutional clients like pension funds, foreign governments, and central banks. It also works with family offices, charitable organizations, and wealthy people.

What Is The Best-Performing Hedge Fund Ever

These are the hedge funds that I think have done the best over the years:

1. Farallon Capital was established in 1986.

$33.1 billion in net gains since the beginning.

Farallon Capital is a hedge fund that has existed since 1986 and invests in public and private assets worldwide.

It uses several investment methods created through careful bottom-up fundamental research and critical thought.

The hedge fund is dedicated to maximizing investors’ profits while minimizing risk. Some of its most well-known investments include long/short stock, merger arbitrage, risk arbitrage, real estate, and direct trades.

2. The Bridgewater Company

The company Bridgewater Associates is based in Westport, Connecticut. It works with big investors such as pension funds, foreign governments, central banks, university endowments, charitable organizations, and more. Ray Dalio, co-chair and co-chief financial officer, started the company in 1975 from his two-bedroom flat in New York.

3. Dan Loeb’s Third Point > Since the business began in 1995, net gains have totaled $18.80 billion. In 2021, net gains will total $3.30 billion, and the assets under control will total $16.50 billion.

4. Management of the Millennium – Israel Englander

Millennium Management is a New York-based hedge fund started by Israel Englander in 1989. It invests in a variety of foreign strategies.

Millennium’s broad investment plans involve investing in a wide range of assets, such as stocks, bonds, currencies, and riskier derivative products.

In particular, the Millennium business plan is based on four main strategies:

RV Fundamental Equity → Both generalists and experts in a particular sector (or sub-sector) do fundamental studies on companies.

Equity Arbitrage: Systematic and fundamental arbitrage involves investing across the whole capital structure, and swaps are often used.

Some popular strategies are event-driven (for example, trading based on rare events), convertible arbitrage, option-volatility trading, and more.

ALSO READ – Hedge Funds Versus Private Equity

What Is The Average Return On A Hedge Fund?

According to the poll, the rate went up from 6.85% to 9.75% per year over an average of 19 months. The poll also showed that hedge funds themselves think this will take up to 29 months longer.

On the other hand, yields rose to +11.02%, which was higher than the level in 2019 (+10.07%) and the highest level since 2009 (+19.44%).

Average yields were high in 2020, but they’ve been high in several years since 2009 (+10% in 2019, +9% in 2017, +10% in 2013, and +11% in 2010).

That’s 11% a year, which is the normal.

However, since the S&P 500 was created in 1957, the standard index has returned 10.7% yearly. This means that the 14.7% annualized gain over the last ten years has been slightly different from normal yields.

Many people have different ideas about what this means for future profits. Still, famous fund manager Stanley Druckenmiller has said there is a “high probability” that the stock market will stay flat for the next 10 years.

ALSO READ – Hedge Funds vs Retail Investors

Final Thought

Now that we have established the hedge funds with the highest returns, we also know that Most hedge funds have minimum investment amounts in the millions of dollars, so they’re not really for regular investors.

Instead, they’re made for businesses and people with much money. Because of this, these companies control billions of dollars worth of selling assets.